Gen Z, Chasing a Rolex, 1 Crore Car, & VIP Parties Every Weekend? Find Out How Much You’ll REALLY Need to Earn in 2025—and Is It Worth the Hype?!

Posted by admin on 2024-12-18 |

The Dream Life: Rolex, Luxury Cars, and Non-Stop Saturdays

Picture this: a shiny Rolex gleaming on your wrist, the roar of a 1 crore car as you cruise down the highway, and exclusive parties every Saturday night, sipping cocktails with the city’s elite. Sounds like the ultimate Gen Z fantasy, right? But here’s the real question: How much do you REALLY need to earn to live this high-flying lifestyle? And is it even worth the hype?

Let’s break it down in a way that’s straight to the point—no sugarcoating. You ready?

The Reality Check: What’s It Gonna Cost You?

Living the "Rolex + 1 Crore Car + Party Every Weekend" lifestyle isn’t a budget-friendly choice. We’re talking about some serious dough. Let’s break down the real costs here.

1. The Rolex Watch

Okay, we’re not talking about a standard watch. You want a high-end Rolex? That’s going to set you back anywhere from ?7 lakh to ?50 lakh. If you're eyeing the iconic Rolex Submariner or a Daytona, you're looking at ?15 lakh to ?30 lakh.

But here’s the catch: buying a watch like that isn’t just a one-off expense. You’re not buying it with your pocket change. You either have to save, take a loan, or rely on your business revenue (if you have one). So let’s say you plan to buy a ?20 lakh Rolex in 2 years. You’ll need to save ?10 lakh per year.

2. The 1 Crore Car

You want to roll with a Porsche 911, BMW 7 Series, or Audi Q7? These cars start at ?1 crore, but the cost doesn’t stop there. Maintenance, fuel, insurance, road tax, and parking fees will easily add another ?5-10 lakh annually.

If you're financing the car (because let’s be real, not everyone drops ?1 crore in cash), the EMI could easily be ?1-1.5 lakh a month. Then, add the running costs. So, total cost of owning a 1 crore car? Around ?20-25 lakh annually when you factor everything in.

3. The Party Lifestyle

Let’s talk partying. We’re not talking about grabbing drinks at the local pub. We mean VIP tables, private events, premium drinks, and ultra-exclusive clubs. A single weekend at these spots could set you back anywhere from ?40,000 to ?2 lakh, depending on the city, venue, and your personal vibe.

If you’re partying like a VIP every Saturday (we're assuming you're not binge-drinking at house parties), you could easily spend ?5-25 lakh a year. That’s ?50,000 to ?2 lakh every month on the social life.

How Much Do You REALLY Need to Earn?

Now, let’s talk numbers. Let’s say you’re living this luxe life, and you’re planning to spend:

Rolex Watch: ?10-15 lakh per year (if you save up over a few years)

1 Crore Car: ?20-25 lakh per year

Partying Every Weekend: ?5-25 lakh per year

Total: ?35 lakh to ?65 lakh per year.

But hold up. Here’s the kicker: Your lifestyle expenses shouldn’t exceed 50% of your income if you want to live comfortably without falling into financial stress or sinking into debt.

That means you’ll need a pre-tax income of around ?1.5 crore to ?2 crore annually to afford this kind of lifestyle without totally draining your savings or depending on credit.

In simpler terms: You need to be making ?12-16 lakh every month just to keep up with these luxury expenses.

The Reality of Earning That Much: Is It Even Possible?

Let’s face it: Most Gen Zers in India are not even close to hitting those numbers. According to LinkedIn, the average salary of a Gen Z professional in India is around ?4-6 lakh annually. So, to live this lavish life, you would need to be earning 10-20 times more than what the average Gen Z employee makes. And that's being conservative.

For reference, only about 1% of India’s population can afford the kind of high-end luxuries we’re talking about. In fact, the luxury goods market in India is growing, but it’s still a niche market, with only a small group of super-wealthy people able to splurge on these items regularly.

But Is It Really Worth It? Here’s The Truth

Let’s stop and think for a minute. Even if you could afford all of this, is it really worth chasing?

1. The Happiness Factor

Studies show that after a certain income level, more money doesn’t actually make you happier. In fact, research from the Happiness Research Institute found that happiness peaks at a moderate income level (around ?15 lakh annually). Beyond that, the increase in happiness is minimal, and the stress of maintaining a high-end lifestyle often outweighs the perks.

2. The Stress of Keeping Up

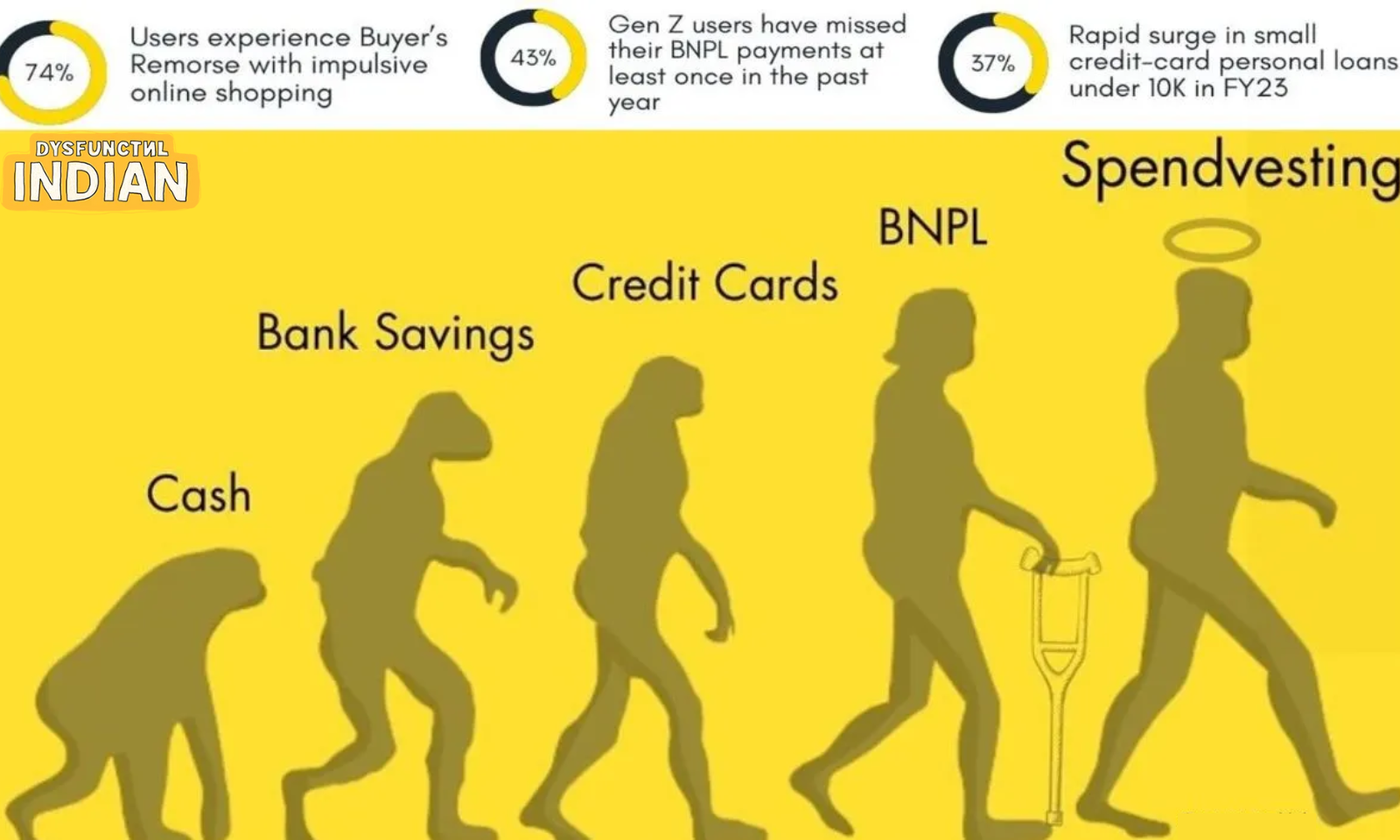

Luxury isn’t just about the car or the watch—it’s about maintaining it. Constantly upgrading, worrying about depreciation, and keeping up with the latest trends can lead to financial stress, burnout, and a sense of never being “enough.” Studies by Psychology Today show that many Gen Z’ers suffer from financial anxiety, especially when comparing themselves to others on social media.

3. Material Wealth vs. Meaningful Happiness

The truth is, experiences and relationships are the true markers of long-term happiness. According to Harvard’s Grant Study, the longest-running study on human happiness, close relationships—not luxury cars or watches—are the biggest predictors of a fulfilling life.

Some Hard Facts You Should Know

Gen Z Income in India: The average Gen Z salary is between ?4-6 lakh annually, which means most of us are far from affording a ?1 crore car, a luxury watch, and partying every weekend.

Mental Health: A 2023 survey found that 40% of young Indians report feeling stressed about their finances and their future. The pressure to “live big” and match the lifestyles we see online is taking a toll on mental health.

The Luxury Market in India: While India’s luxury market is growing, it remains a niche, with only 1% of the population able to truly afford this lifestyle. If you're planning to live it, you’re already in the 1%—and it comes with its own pressures.

The Bottom Line: The True Cost of Chasing The Dream

Sure, the idea of living in a luxury car, rocking a Rolex, and partying every weekend is tempting, but it comes with a price—financially and mentally. At the end of the day, the things that matter most—meaningful connections, purpose, and good health—don’t come with a price tag.

If you can afford the Rolex, the car, and the parties, go ahead and enjoy it. But don’t let it define your life. True success is about financial freedom, mental peace, and the freedom to live on your own terms, not about chasing an Instagram-perfect lifestyle.

Conclusion:

Dream big, work hard, but don’t let the pressure to live a luxe life mess with your happiness or future. The best things in life? They’re priceless—so don’t spend your life chasing things that won’t bring you lasting joy.